Office Hours

Contact me to schedule a virtual meeting

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking

Jose Gutierrez

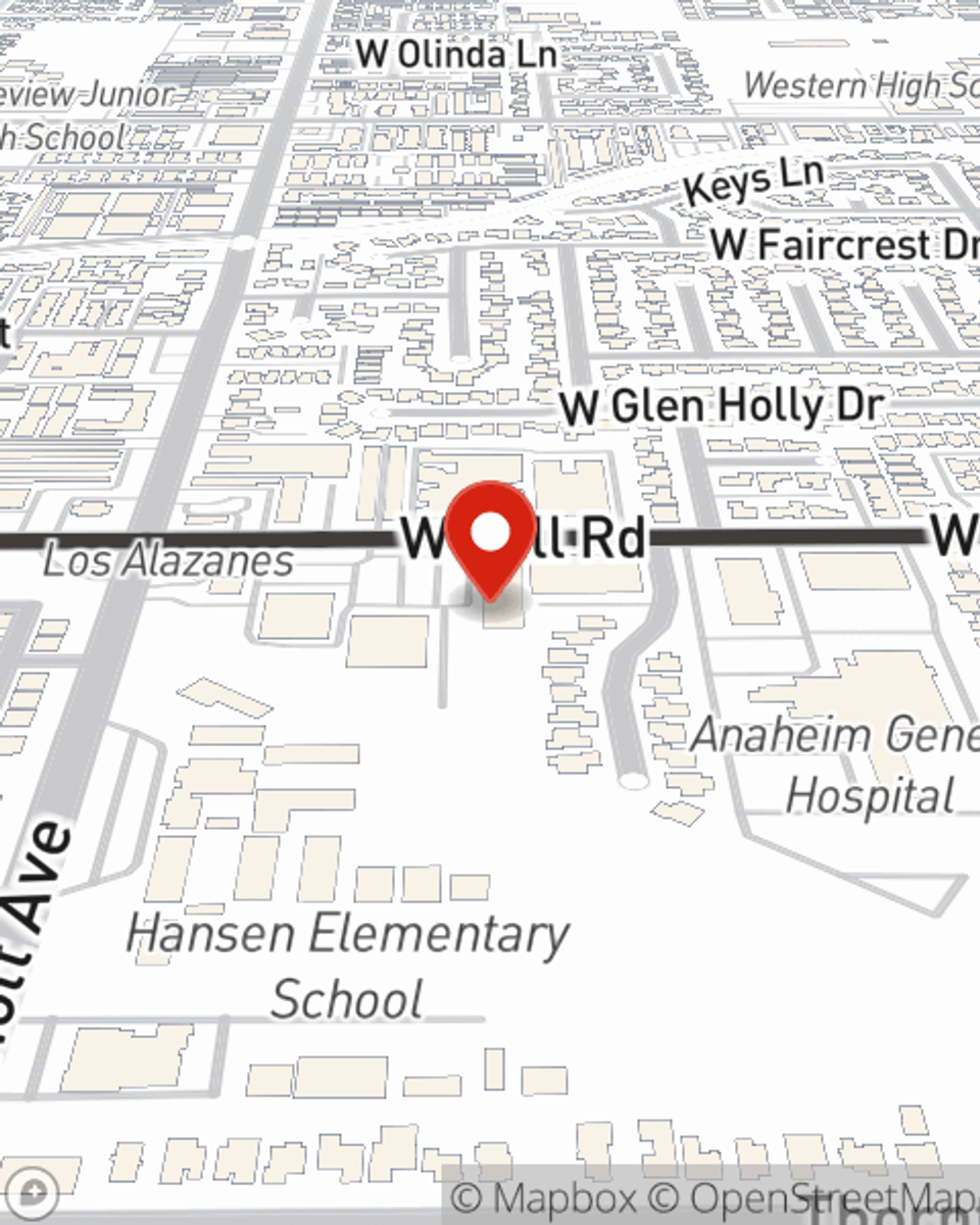

Jose Gutierrez Ins Agcy Inc

Office Hours

Address

Anaheim, CA 92804-3726

Would you like to create a personalized quote?

Would you like to create a personalized quote?

Office Info

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking

Office Info

Simple Insights®

The Real Consequences of Drunk Driving

The Real Consequences of Drunk Driving

What's at stake if you're caught drunk driving? A lot. These tips help you avoid the dangers of drinking and driving.

How to register a car at the DMV

How to register a car at the DMV

Car registration requirements at the DMV can vary depending on the state that you live in.

Maintaining a historic home

Maintaining a historic home

With a historic home, completing these home maintenance tasks a little bit at a time could improve the overall resale value of your home.